News & Resources

Overview

In the Residential Services sector, demand remains robust despite deal volume decreasing from the heightened levels in 2021. Increased focus on home improvement and time spent at home, prompted by widespread work-from-home policies, has persisted, keeping demand high for residential services. Consolidation efforts within the industry are ongoing, particularly evident in industries like HVAC and plumbing, which are nearing maturity. Conversely, industries like restoration are still in the early stages of consolidation and are continuing to attract significant interest from both strategic and financial investors.

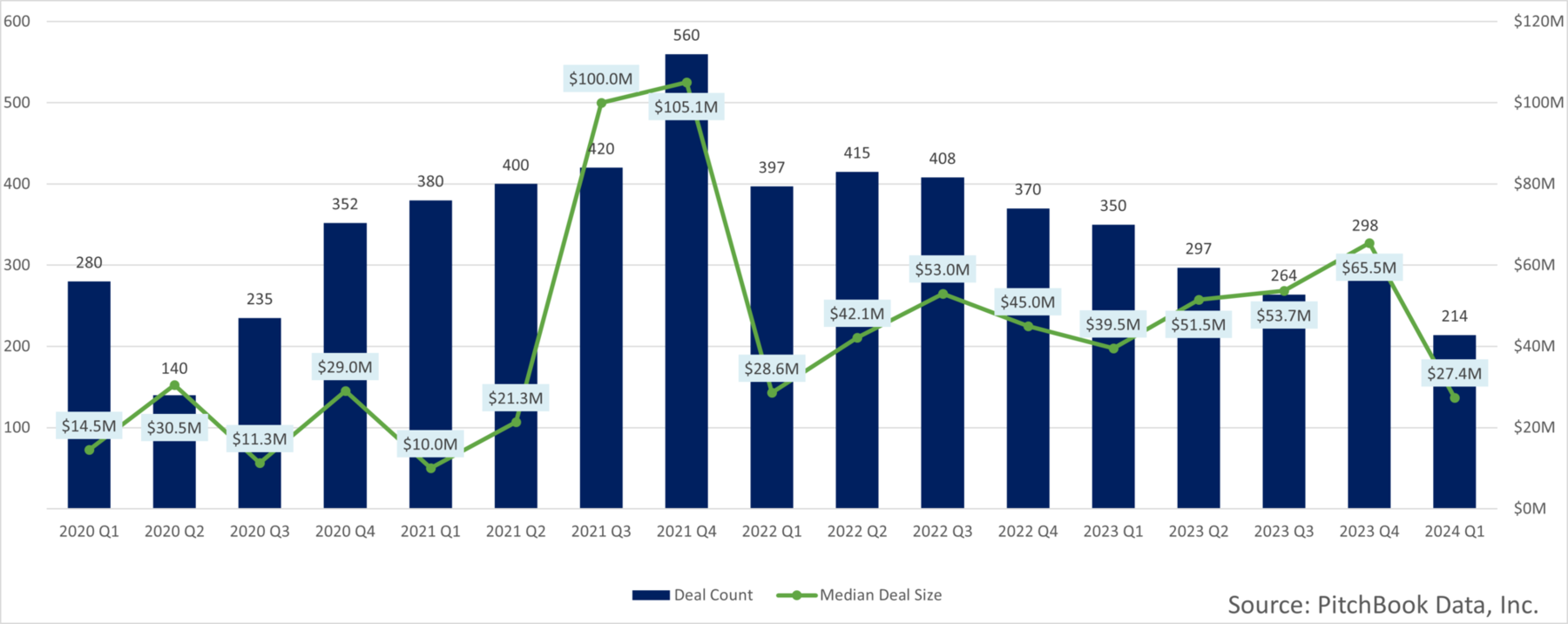

Coming from the highs of 2021, the M&A market has seen decreased deal multiples and levels of activity across industries, and Residential Services is no exception. Residential Services deal volume has steadily decreased since Q4 of 2021, and Q1 2024 marks the slowest start to a year since 2020. While multiples in residential services are still high compared to other similar industries, due to heavy consolidation and private equity interest, they have fallen from the highs seen in 2021 and 2022. Despite this decline, which is largely due to high interest rates and cautious macro-economic sentiment, the underlying confidence in the Residential Services investment landscape persists. This confidence, coupled with ample deployable capital, should continue favorable valuations for owners of quality businesses moving forward.

Key Insights

M&A activity in the Residential Services space continues to be an area of increased interest, driven particularly by companies in HVAC, plumbing, restoration, pest control, roofing, and landscape services.

As the Fed decides to keep interest rates high for longer than expected, more Americans are choosing to stay in their current homes rather than moving and taking on a new mortgage. This is driving sustained interest in home improvement projects and services.

The 2023 median deal size in the lower middle market saw steady increases from $39.5M in Q1 to $65.5M in Q4. While median deal size decreased in Q1 of 2024, we have already seen deal sizes return to similar levels to those seen throughout 2023 in Q2 of 2024.

As consolidation continues to deplete supply for quality companies and demand remains high; we expect to see deal volume further normalize and valuations remain strong.

Reflections from the Restoration Industry Convention (RIA)

The Restoration Industry Association Convention

The growing Restoration Industry Association (RIA), a trade organization made up of professionals from over 1,300 cleaning and restoration member-firms, hosted a well-attended convention and industry expo in Dallas from April 8th-10th. Coming off a mild-weathered 2023, optimism about a strong 2024 for the industry echoed throughout the show. Alexander Hutton’s Shane Jansen attended for the second year in a row, building and strengthening relationships with business owners and gaining valuable industry insights.

Industry Tailwinds

Professionals in restoration were excited about what’s to come for the industry. America’s aging home stock was often cited as a tailwind for the industry, as the average American home is over 40 years old and many are in need of maintenance and repair. Decaying infrastructure in homes and commercial buildings will only lead to more loss events. Additionally, severe weather events continue to become more frequent across the country, creating seasons of extreme demand for restoration services.

Consolidation and M&A Opportunities

The positive trends in restoration continue to attract investors to the industry. This year’s show had more private equity (PE) firms in attendance than previous years, including some firms that already had large platforms seeking add-on acquisitions as well as others looking to enter the industry with an initial investment. Many at the conference had heard rumors of private equity funds preparing to sell their platforms and realize significant gains. The anticipation of significant returns from this “buy-and-build” strategy has drawn even more financial buyers into the industry. One private equity professional said, “we missed out on the HVAC and plumbing consolidations, we won’t miss out on this one.”

Those looking to consolidate in the industry are ultimately seeking economies of scale; they want to create regional or national brands that can set up master service agreements with large-scale property owners. Reaching that size provides opportunities that local and semi-regional players are not able to access. However, given the importance of exceptional service and customer satisfaction in the restoration industry, maintaining a strong culture and brand throughout the organization will be paramount.

We expect M&A activity in the restoration industry to remain incredibly strong over the next few years, as this roll-up is still in its early stages. For businesses in the industry considering a sale, the key is not simply finding a willing buyer, but ensuring that you choose the right partner for your customer, employees, and legacy.

About Alexander Hutton

Led by a team of former business operators and executives who have built and sold companies, Alexander Hutton is a boutique, middle market M&A advisory firm that has completed over 220 successful transactions. We offer a unique understanding of what it takes to run a business and an accessible team dedicated to client service. By running a high-touch, competitive transaction process for each of our clients, we are able to help them achieve their ideal outcome.